Convoluted Contracts’ Negative Impact on Global Supply Chain Costs

Contractual relationships between global supply chain counterparties are governed by broad parameters set by the International Chamber of Commerce. Standard language on delivery and costs have defined the terms to clarify tasks and risk for all parties involved, including buyers and sellers.

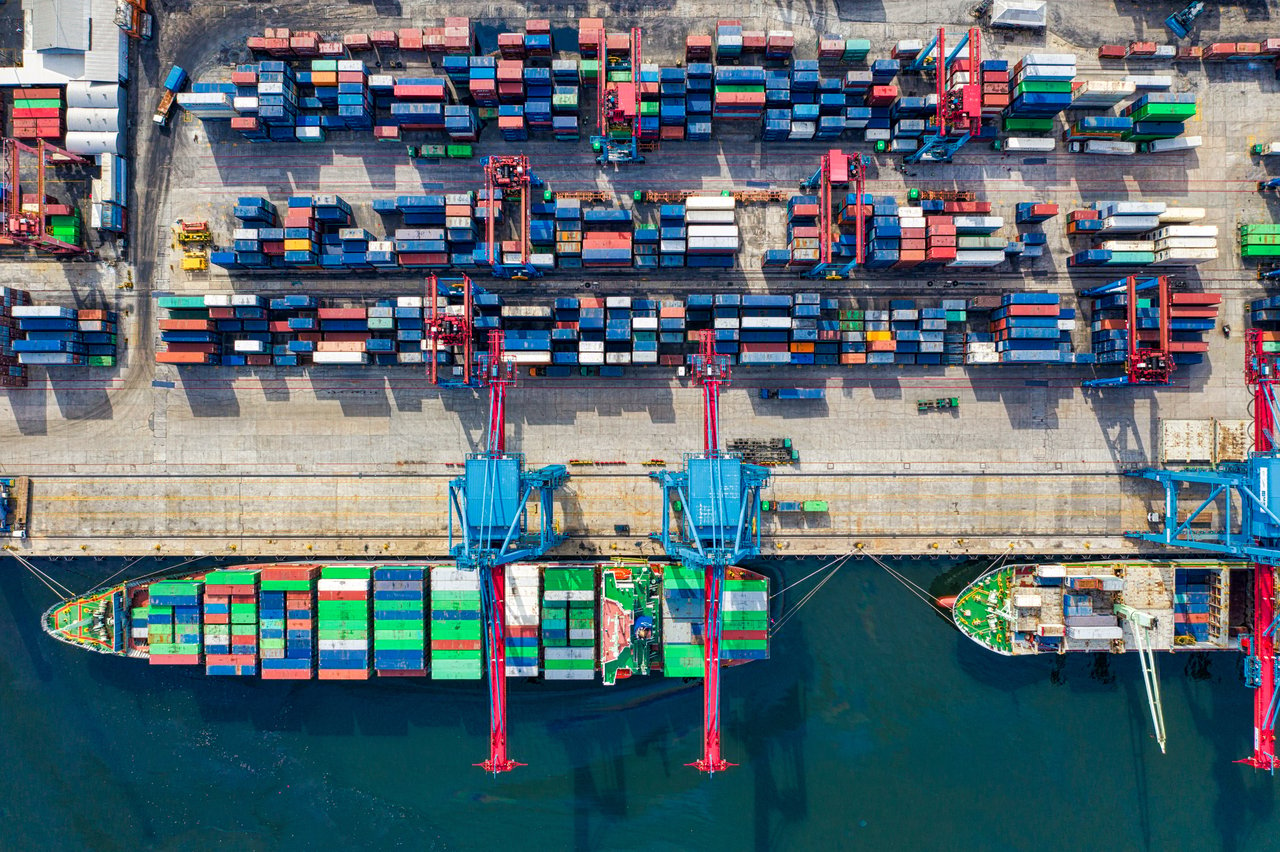

But COVID-19 and its many complexities have -- and continue to -- reposition the numerous responsibilities involved across commercial transactions. With soaring costs of raw materials, persistent shipping delays, geopolitical risks and other obstacles, contract disputes between counterparties are on an aggressive uptick over how to account for cost inflation, mistrust surrounding prioritization of shipments and delivery shortfalls.

Dire Need for Better Flow of Information

Historically, supply chain operations rely on event data collected by human observations. The execution of each contract hinges on this data from multiple parties, with each source requiring manual input and verification. Extrapolate this time- and resource-intensive process across the 10 to 20 entities to a contract and inflated operational costs are magnified.

With information inhibited in silos between and within companies, costs continue to rise along the chain. For instance, financing charges are added onto a commodity price where the operator receives payment at 90 days, then the supplier receives payment at 150 days, and on goes the trickle-down effect until profit is eliminated. The lack of data sharing between counterparties is an under-realized yet significant contributor to increased transaction costs.

No Tolerance for Gray Areas

Ambiguous and convoluted terms in supply chain contracts result in issues like payment delays and costly dispute and reconciliation processes. Supply chain professionals need to eliminate all gray areas from the contracting process, especially given the daily uncertainties of today’s environment.

Every contract must now be explicitly defined, measurable and enforceable. This new level of specificity can significantly lower both risk and cost amid supply chain uncertainty by enabling counterparties to mimic the business to consumer (B2C) contract model where payment is received ‘bill-on-consumption’ not ‘bill-on-fill.’

Technology as Boon for Trust

To alleviate costs, trust must be fostered and built among suppliers and counterparties. Raw market and logistical costs will always vary, but executing transactions through smart contracts can mediate fluctuations. Smart contracts, backed by the immutable power of blockchain technology, can tap real-time field and sensor level data in addition to other Industrial Internet of Things (IIoT) devices to verify exactly what happens and where, and then automate the execution of contracts.

Just as one pays for gas at a gas station using a credit card without human intervention, commercial transactions can function the same way with quick and smooth transactions with zero delays. There is no reason why industrial transactions shouldn’t be as seamless as pumping and paying for gas.

Smart contracts generate a mutually agreed upon source of truth by codifying existing natural language contract terms between parties for a range of service and performance contracts. This record then serves as the foundation to automatically eliminate payment delays, disputes and complicated reconciliations - significantly reducing transaction costs.

Additionally, maintaining a trail of transactions that reveals who has what, when and wherein a supply chain is invaluable. Smart contracts therefore, can reduce -- or even eliminate -- the time and resources necessary in confirming the commodity custody timeline; a real win for counterparties navigating the costs and complexities impacting the global supply chain. As a bonus, this also provides verification of the carbon footprint of the transaction, but that’s a subject for another day.

--

This article was authored by Andrew Bruce and originally appeared at Supply & Demand Chain Executive.