Thriving in a Lower Forever Oil & Gas Environment

Oil and gas companies are looking to implement technology to shore up core business processes and accommodate a multitude of consequences currently facing that the industry.

Figuring out how to operate on ultra low to zero margins is now imperative to survival. Numerous vendors, suppliers and operators hunkered down through the 2014-2016 pricing shock without making many changes; that is not the case this time around.

While we await a new normal to reveal itself, one thing is clear: industry has to innovate to become lean and agile by rooting out inefficient, sluggish legacy systems and other outdated ways of doing business.

To operate in a “lower forever” environment, oil and gas companies must adopt better ways to improve core processes and operations that includes digitizing paper-based workflows and automating contractual relationships.

Reducing the Costs of Doing Business

With 2020 annual revenue at a predicted $3.3 trillion, contracts are a staple of industry foundational to the governance of vendor, operator and supplier interactions. As such, contracts have long been a tool for the diversity of interest marked by shared risk between participants.

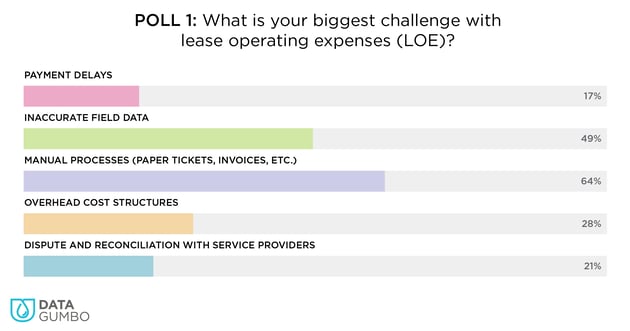

However, traditional paper contracts are quickly becoming a relic of pre-downturn times. Resource-intensive and error-prone manual ticketing systems, Excel spreadsheets and paper contracts are slow, expensive and yield hefty inefficiencies as a result of administrative drag, sluggish dispute and reconciliation procedures and unprovable contractual ambiguities.

It’s time for the oil and gas industry to stop accepting these factors as unavoidable costs of doing business. Millions of dollars are left on the table every month with operators unable to capture fast pay discounts, contract incentives and/or pay for services actually delivered instead of believed to be delivered.

The fundamental issue at hand is trust. But now, the market conditions are catalyzing a better approach that solves for numerous industry pain points including lack of speed, trust, accuracy and visibility. Blockchain-powered smart contracts are providing trust that guarantees transactional certainty.

Blockchain and the Efficiencies of Smart Contracts

With a market size set to exceed $23.3 billion by 2023, blockchain technology has moved beyond the hype and is being tapped by some of the biggest companies in the world — Walmart, Oracle, Target. Its shared, transparent immutability makes it pivotal for supplying trust to counterparties and supply chain participants.

Blockchain works by using distributed ledger technology to capture data that is is fed to a computer program called a smart contract that calculates payments per the real-world contract terms and creates transaction blocks. As source data is recorded into a data block in a blockchain network, it is replicated and shared with each contractual party for review and to garner instantaneous consensus approval.

Each block contains contemporaneous documentation to substantiate a transaction and is linked to the previous block using a “hash.” A hash is generated when a new block gets created to link the transactions and render information impervious to fraud or interruption. This single record of truth can then be used to power smart contracts to automate payments and streamline efficiencies.

Smart contracts function in lockstep with natural language contracts as software coding programs. Essentially, various contract participants define contractual terms upfront, and agree on performance deliverables and metrics that will be calculated using existing operational field data sources against set tolerances. Most often, these sources include a hybrid of information gathered by a neutral third party that can reach across multiple companies and systems to pull specific data and then store all relevant data and documents to a blockchain as an immutable record of real-time events.

Smart contracts integrate with Enterprise Resource Planning (ERP) systems like SAP, Oracle or QuickBooks. When the blockchain record triggers automatic pre-reconciled payments, as often as daily depending on how the smart contracts language is structured, this means suppliers get paid faster for services and products, and owner/operators pay only for what is actually delivered or executed, thus freeing up working capital.

Every Dollar Counts

With the ability to reduce contract costs an average of five to 25%, the technology yields multimillion dollar savings opportunities. By automating billings, removing error-prone manual transactions and eliminating contract leakage, smart contracts solve for disputes, back-office reconciliations and debilitating DSOs.

Whatever the new normal looks like, the automation of business transactions will be a surefire part, enabling value on all sides of a contract.